Environment

Disclosure Based on the TCFD Recommendations

Disclosure Based on the TCFD Recommendations

The Mitsuboshi Belting Group has set “response to climate change” as one of the material issues (materiality) in management. Moreover, in December 2022, Mitsuboshi Belting announced its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)*1 and joined the TCFD Consortium,*2 a forum for discussion among supporting companies and financial institutions, in order to further accelerate its initiatives related to climate change.

We promote our efforts to enhance climate change initiatives and disclose the relevant information in a timely and appropriate manner based on the TCFD framework, aiming to further improve engagement with all stakeholders.

※1 The TCFD is a task force established by the Financial Stability Board (FSB) in 2015 at the request of the G20, which recommends that companies assess the financial impact of climate change risks and opportunities and disclose information based on four categories: governance, strategy, risk management, and metrics and targets.(TCFD website: https://www.fsb-tcfd.org/)

※2 The TCFD Consortium is an organization and consortium established as a forum for companies and financial institutions that support the TCFD recommendations to work together to promote effective corporate information disclosure and to discuss measures to link disclosed information to appropriate investment decisions by financial institutions.

(TCFD Consortium website: https://tcfd-consortium.jp/en)

Governance

【Board of Directors’ monitoring system for climate change-related risks and opportunities】

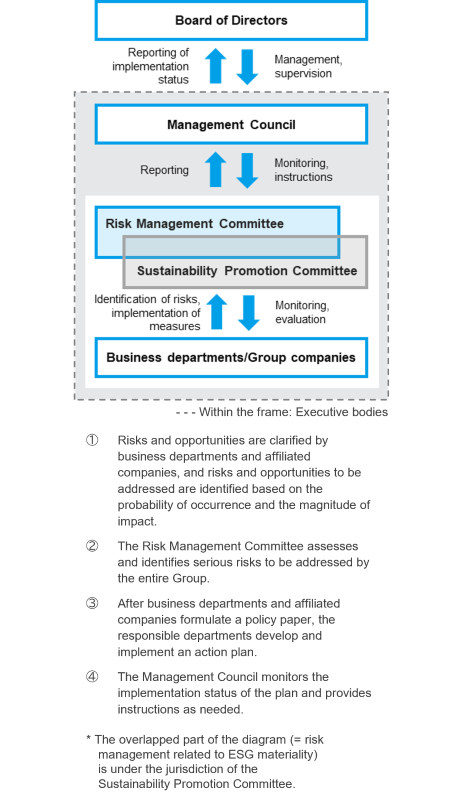

Regarding the direction of management related to climate change, proposals that are summarized based on climate-related risks and opportunities by the Sustainability Promotion Committee (Deepening ESG Management) are reported to the Board of Directors through the Management Council, which deliberates on, decides, and supervises important matters in the execution of business. The Board of Directors makes decisions and supervises climate change-related initiatives.

【The role of management in assessing and managing climate change-related risks and opportunities】

Regarding the progress of efforts to address material issues (issues to be addressed with priority), sustainability promotion organizations (business departments, committees, or working groups) in charge of the measures determined for each issue report the implementation status to the Sustainability Promotion Committee, which reviews and monitors their efforts and checks their progress against the targets and their issues, aiming for continuous improvement.

For response to climate change, which is one of the material issues, the Sustainability Promotion Committee discusses “GHG emission reduction activities,” “energy-saving activities,” “development of eco-friendly products,” and other topics. Main agenda items are shown in the table “List of main agenda items of the Sustainability Promotion Committee” in Deepening ESG Management.

Risk management

【Process for identifying and assessing climate change-related risks】

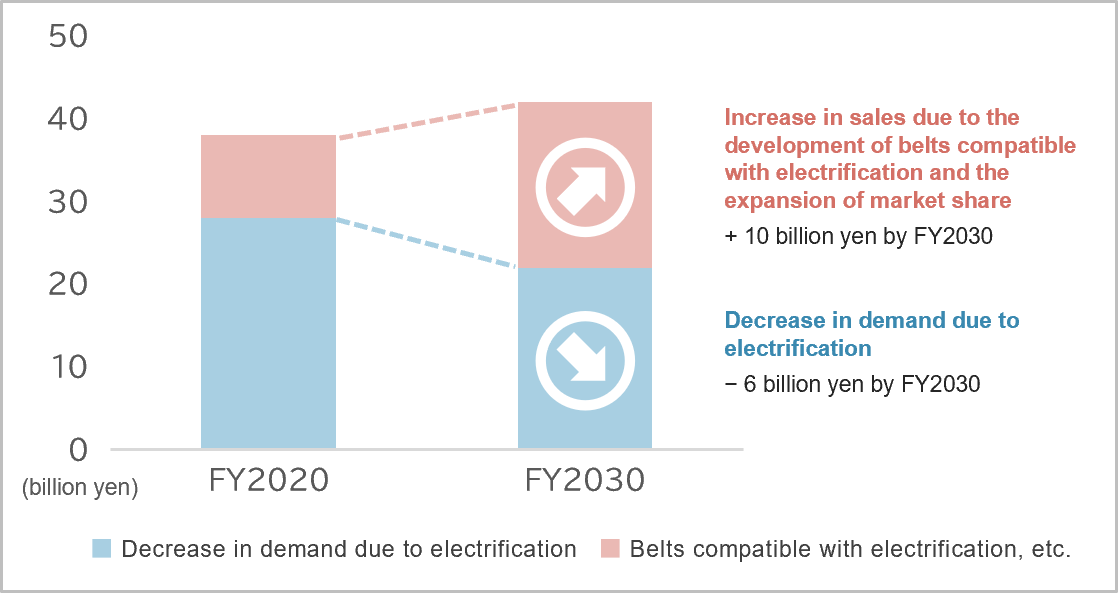

Climate change-related risks and opportunities are clarified by all business departments and affiliated companies, and the Risk Management Committee (chaired by a director and composed of responsible persons from all business departments and affiliated companies and from all management departments of the Head Offices) identifies risks and opportunities to be addressed based on the probability of occurrence and the magnitude of impact (Impact: large – 1.0 billion yen or more, medium – 0.1 to 1.0 billion yen, small – less than 0.1 billion yen; Time frame: short term – until 2025, medium term – until 2030, long term – until 2050).

【Process for managing climate change-related risks】

The responsible persons of business departments and affiliated companies summarize the identified risks and opportunities, clarify issues to be addressed, measures to be taken, responsible departments, and targets, and develop them into a policy paper to obtain approval from the President. Based on the approved policy paper, the responsible departments develop an action plan, which is implemented after being approved by the responsible persons of business departments and affiliated companies.

The implementation status of an action plan is monitored and evaluated by the responsible persons of business departments and affiliated companies, and in principle, is reported to and reviewed by the Management Council once a year. The review results are reflected in a policy paper for the next fiscal year. The implementation status of measures to address material issues in ESG management is reported to the Sustainability Promotion Committee once a month, which provides instructions on and evaluates it as necessary.

【Integration of climate change-related risk management and overall risk management】

The Risk Management Committee Secretariat prepares a serious risk plan that clarifies measures, targets, and responsible departments for serious risks, and decides on the plan after deliberation by the Risk Management Committee. Details of the plan are reported to the Management Council through the Risk Management Committee. Measures against the identified serious risks are monitored and evaluated on a daily basis by the responsible persons of business departments and affiliated companies to which the responsible departments belong, and the monitoring and evaluation results are reported to the Risk Management Committee.

For risks related to climate change, in FY2022, the Risk Management Committee identified “a decrease in corporate value due to failure to achieve CO2 emission reduction targets” as one of the serious risks. GHG emission reduction activities, conducted by business departments and affiliated companies, were monitored and evaluated by the Risk Management Committee, and the monitoring and evaluation results were reported to the Board of Directors together with other significant risks.

Regarding risks related to climate change and ESG materiality, the Sustainability Promotion Committee, together with the Risk Management Committee, manages the progress of measures to address the relevant risks.

Strategy

With the aim of verifying the impact of climate change on the value chain of the Mitsuboshi Belting Group in the future and the effectiveness of climate change measures, we conducted scenario analysis based on two climate change scenarios: a 1.5℃ warming scenario, in which the trend towards decarbonization continues to grow and the impact of transition risks and opportunities increases, and a 4℃ warming scenario, in which climate change progresses significantly and the impact of physical risks increases.

【Scenario analysis】

Analysis target and preconditions

|

Region |

Period |

Range |

Main reference scenarios |

|---|---|---|---|

|

Countries and regions in which the Mitsuboshi Belting Group operates |

From 2022 to 2050 |

Value chain |

IEA WEO 2022, IPCC AR6 (SSP 1-1. 9, SSP 3-7. 0, SSP 5-8. 5), etc. |

Future vision of society surrounding the Mitsuboshi Belting Group’s business

| Scenario | 2030 | 2050 |

|---|---|---|

| 1.5℃ scenario |

2030

|

2050年

|

| 4.0℃ scenario |

2030

|

2050

|

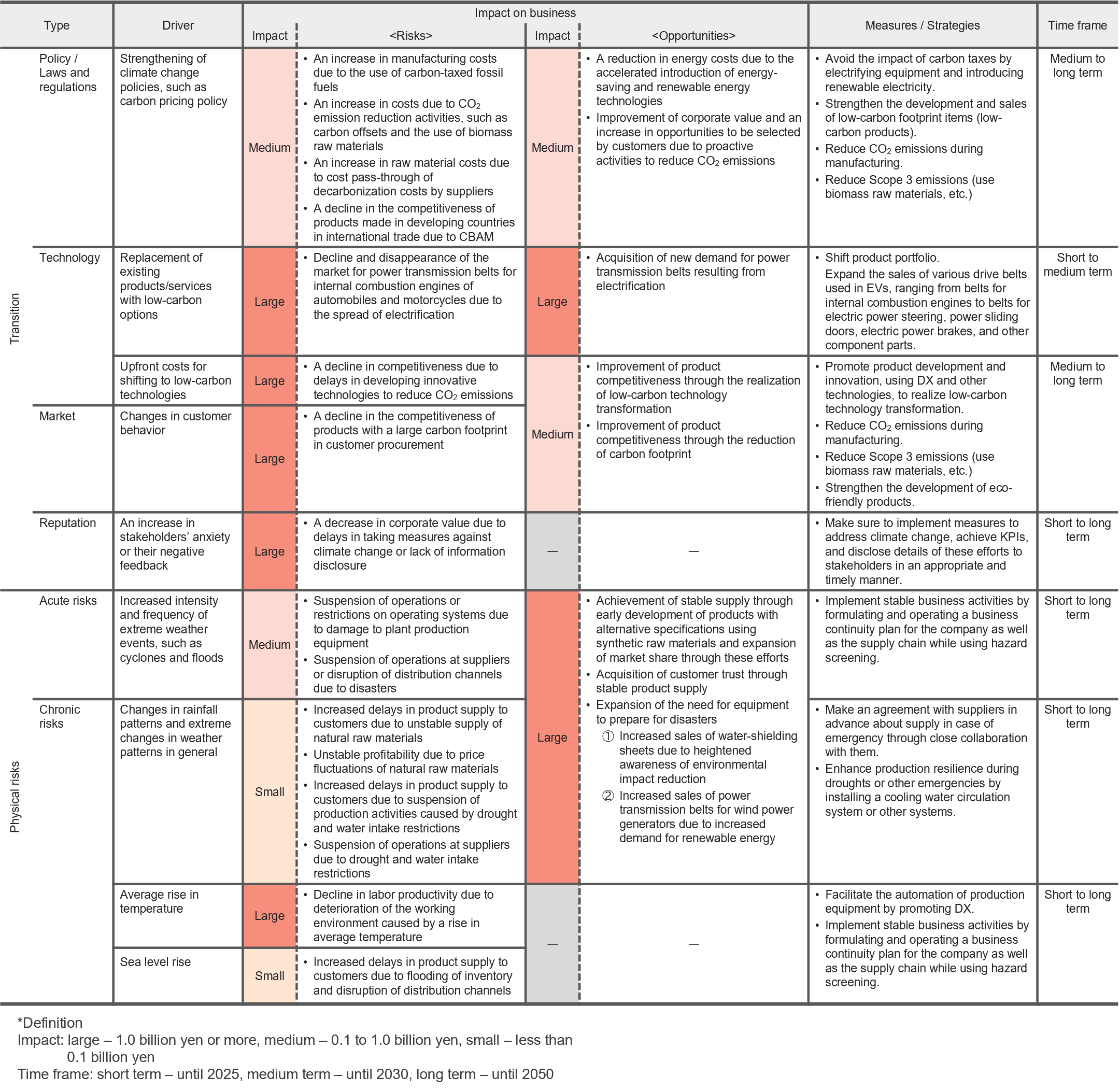

【Risks and opportunities】

Sales plan for the automobile industry by product category

Risks and opportunities associated with the spread of electrification of automobiles

With the electrification of automobiles, the demand for power transmission belts for internal combustion engines is expected to decrease by approximately six billion yen by fiscal 2030. Meanwhile, we expect an increase in sales of approximately 10 billion yen due to increased sales of timing belts for electric units (EPBs, EPSs, PSDs, etc.) in automobiles and belts for rear-wheel drives of electric motorcycles for the same period. Taking the progress of electrification of automobiles as an opportunity, we will strive to develop products that can achieve sustainable growth.

Metrics and targets

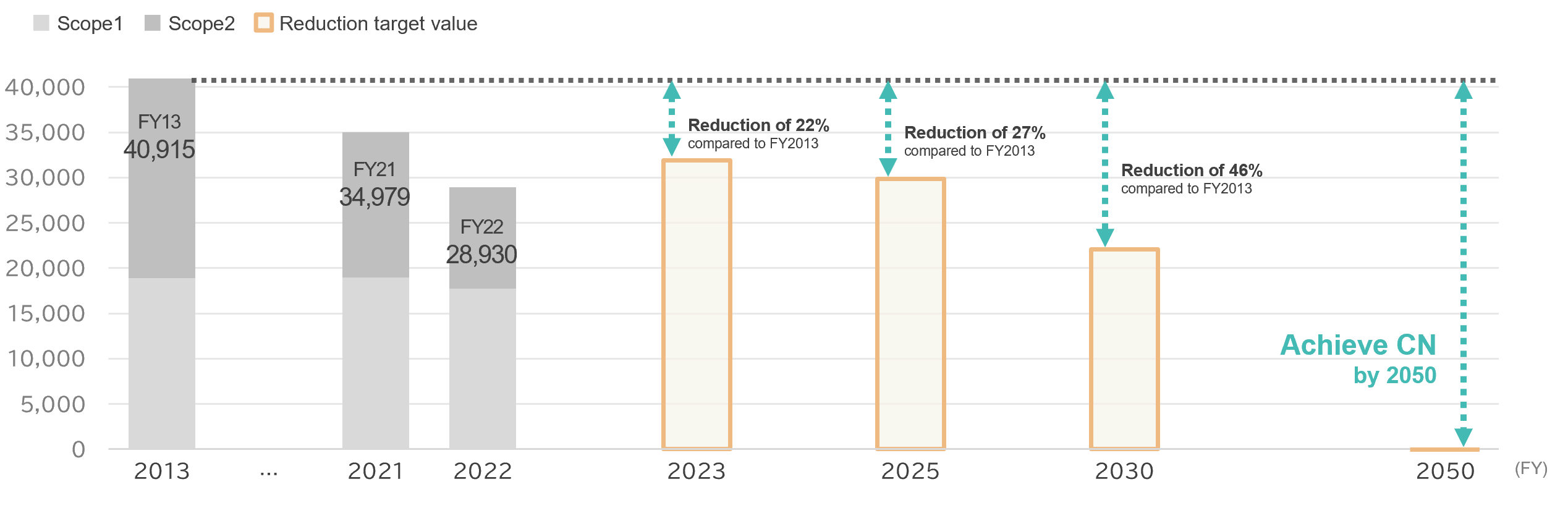

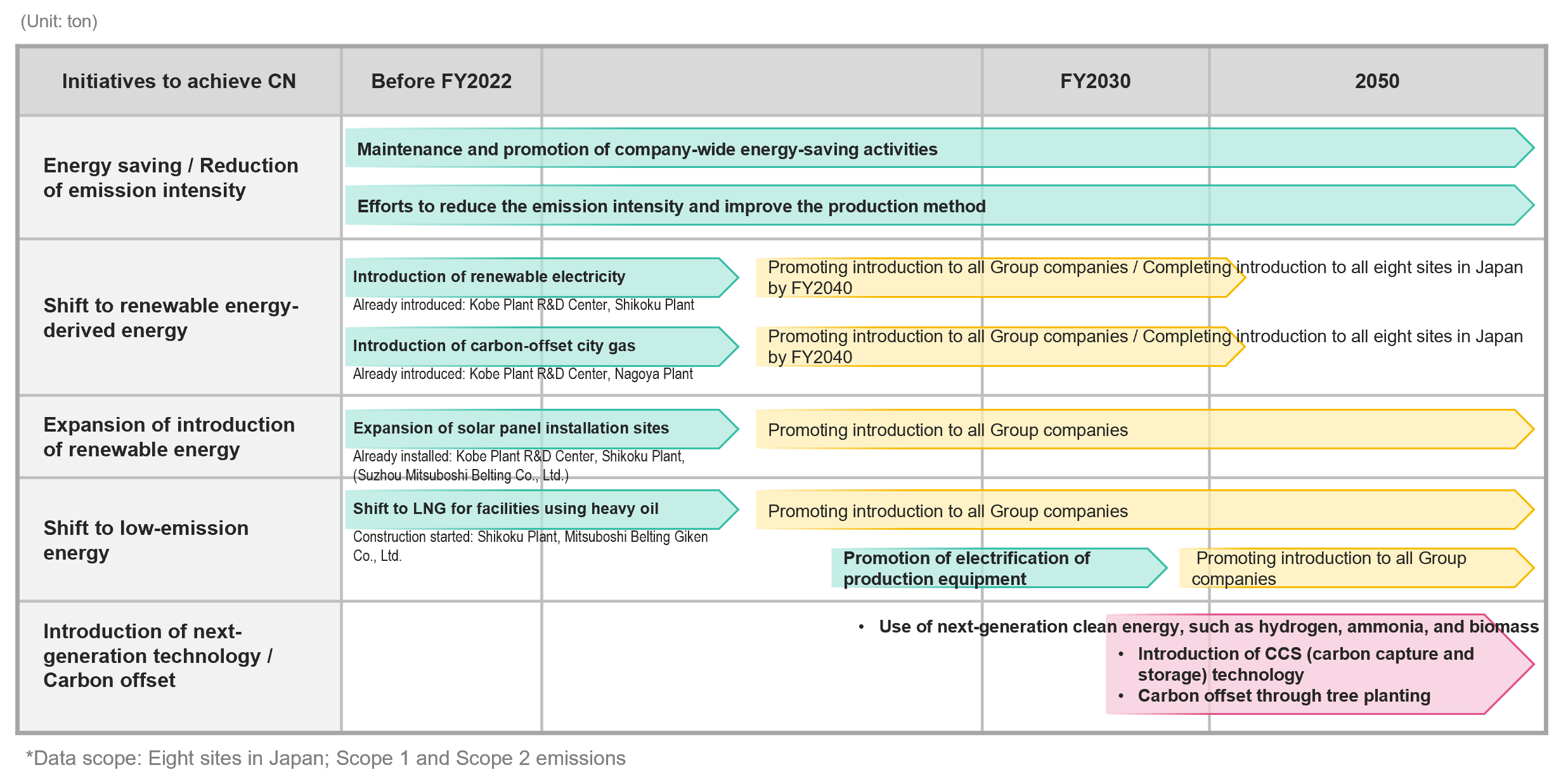

CO2 emissions reduction plan (as of March 2023)

In 2019, the Mitsuboshi Belting Group set medium- to long-term CO2 emission reduction targets to help curb global warming. However, as the urgency of responding to climate change increased, we reviewed our targets and set reduction targets for the interim year (FY2025) as well in 2022 to be more ambitious in reducing CO2 emissions.

Although we have currently set CO2 emission reduction targets for Scope 1 and Scope 2, targeting eight sites in Japan, we will begin aggregating CO2 emissions, including Scope 3 emissions, of the entire Group including overseas plants, to establish emission reduction targets.